mississippi income tax brackets

Mississippis income tax brackets were last changed seven years prior to 2016 for. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket.

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Mississippi also has a 400 to 500 percent corporate income tax rate.

. There is no tax schedule for Mississippi income taxes. Mississippi Income Tax Brackets and Other Information. The latest available tax rates are for 2020 and the Mississippi income tax brackets have not been changed since 2018.

5 on all taxable income over 10000. Mississippi based on relative income and earningsMississippi state income. Sales tax rate.

PAYucator - Paycheck W-4 Calculator. All other income tax returns P. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Mississippi Income Tax Rate 2022 - 2023. W-4 Check - Paycheck Based W-4 Form.

Mississippis income tax brackets were last changed two years prior to 2018 for tax year 2016 and the tax rates have not been changed since at least 2001. W-4 Adjust - W-4 Form Tax Return Based. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Box 23050 Jackson MS 39225-3050. Income tax brackets are required state taxes in. Tax Bracket Tax Rate.

Mississippi has a graduated tax rate. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent. Mississippi Income Taxes.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. If you are receiving a refund PO. Search For Ms taxation With Us.

Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Mississippi State Married Filing Jointly Filer Tax Rates Thresholds and Settings.

Box 23058 Jackson MS 39225-3058. Ad Find Ms taxation. Mississippi Income Tax Brackets.

Mississippi Income Tax Forms. 2022 Tax Calculator Estimator - W-4-Pro. 3 on the next 3000 of taxable income.

What is the Single Income Tax Filing Type. Mississippi State Income Tax Forms for Tax Year 2021 Jan. Ad Compare Your 2022 Tax Bracket vs.

Details on how to only prepare and print a Mississippi 2021 Tax Return. The graduated income tax rate is. As fiscal year 2023 begins the 4 tax on an individuals first 4000 of taxable income will be eliminated entirely.

4 on the next 5000 of taxable income. This means that these brackets applied to all income earned in 2018 and the tax return that uses these tax rates was due in April 2019. Your 2021 Tax Bracket To See Whats Been Adjusted.

STIMUlator - Recovery Rebate Credit. Mississippi State Single Filer Personal Income Tax Rates and Thresholds in 2022. If youre married filing taxes jointly theres a tax rate of 3 from 4000 to 5000.

The state income tax system in Mississippi is a progressive tax system. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. RATEucator - Income Brackets Rates.

Single is the filing type used by all individual taxpayers who are not legally married and who have no dependants for whom they are monetarily responsible. Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. Mississippi one of the poorest states in the nation has struggling rural hospitals and perpetually underfunded schools.

Detailed Mississippi state income tax rates and brackets are available on this page. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. This means that these brackets applied to all income earned in 2015 and the tax return that uses these tax rates was due in April 2016.

Tate Reeves on Tuesday signed a bill that will reduce the state income tax over four years beginning in 2023. The Mississippi tax rate and tax brackets changed from last year dropping the 3 bracket. The tax brackets are the same regardless of your filing status and.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. 0 on the first 2000 of taxable income. Discover Helpful Information And Resources On Taxes From AARP.

The tax brackets are the same for all filing statuses. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Then two years.

Start filing your tax return now. W-4 Pro - Tax Return Based W-4 Form. These rates are the same for individuals and businesses.

The 5 tax on income over 4000 will also be reduced to 47. Mississippi Single Tax Brackets TY 2021 - 2022.

The Steep Cost Of Medical Co Pays In Prison Puts Health At Risk

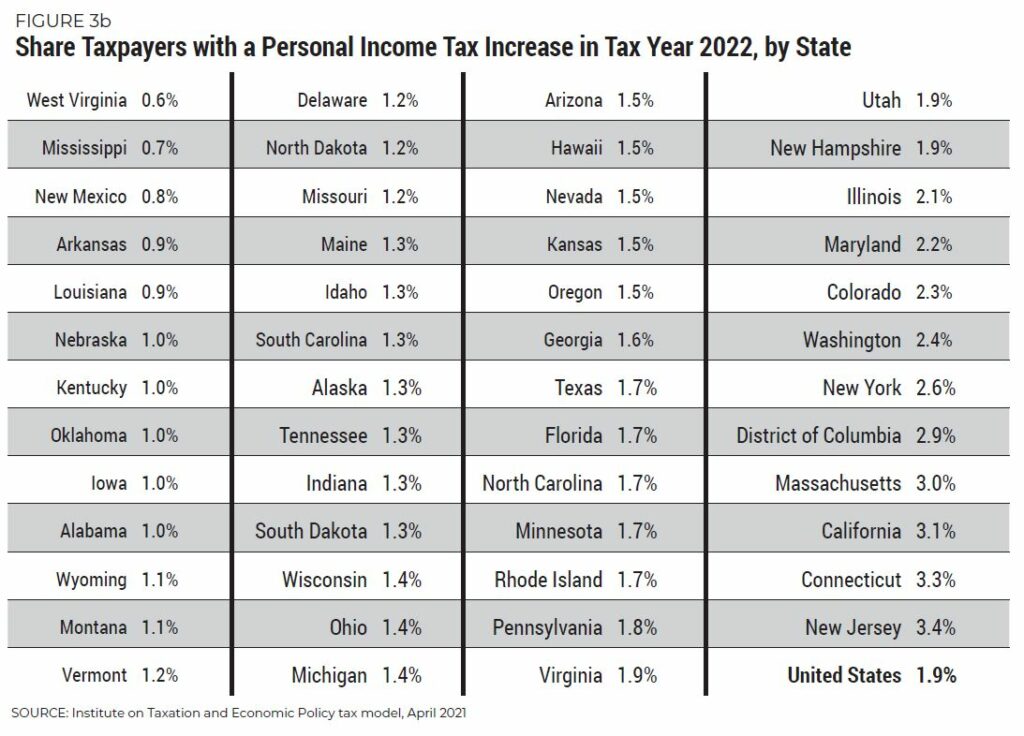

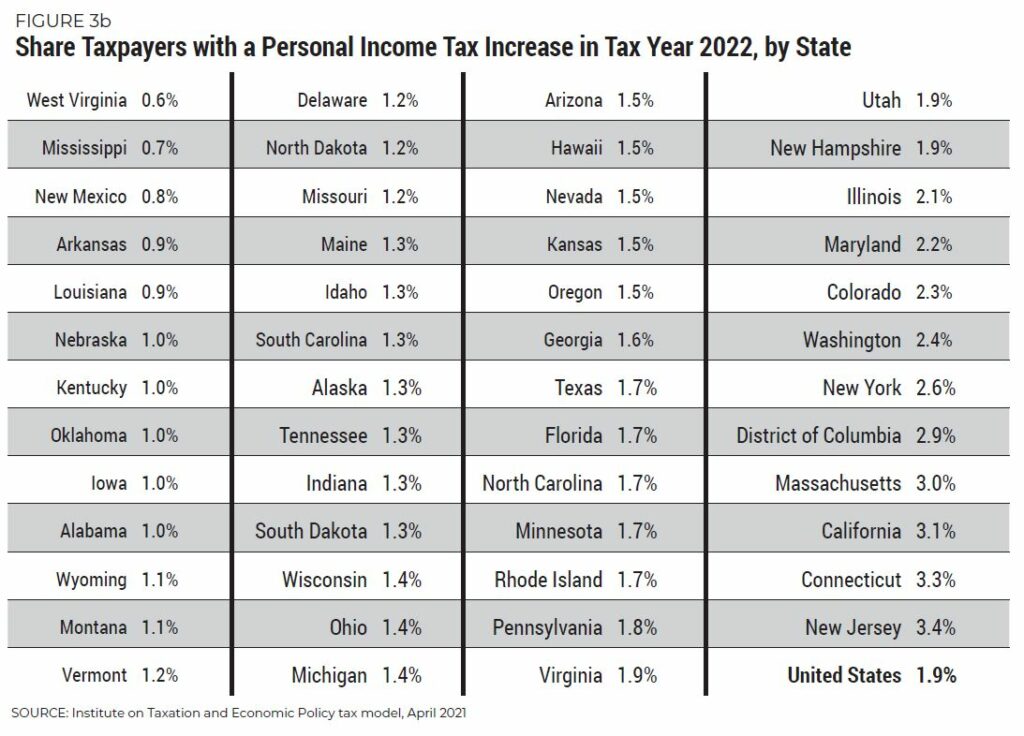

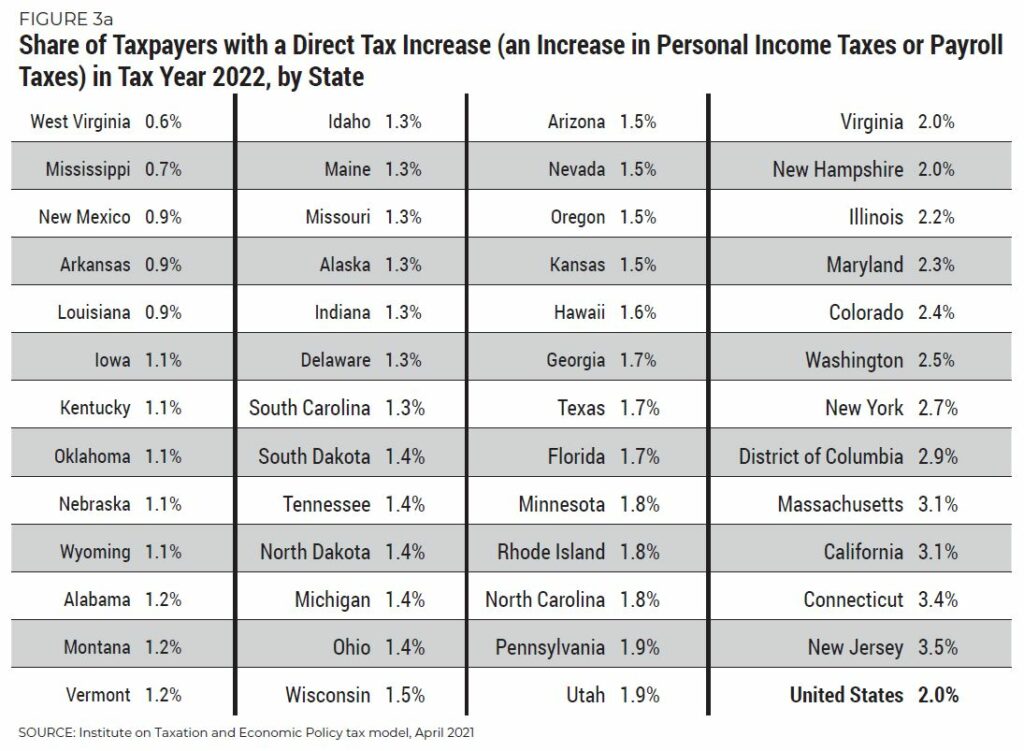

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map States

State By State Guide To Taxes On Retirees Kiplinger

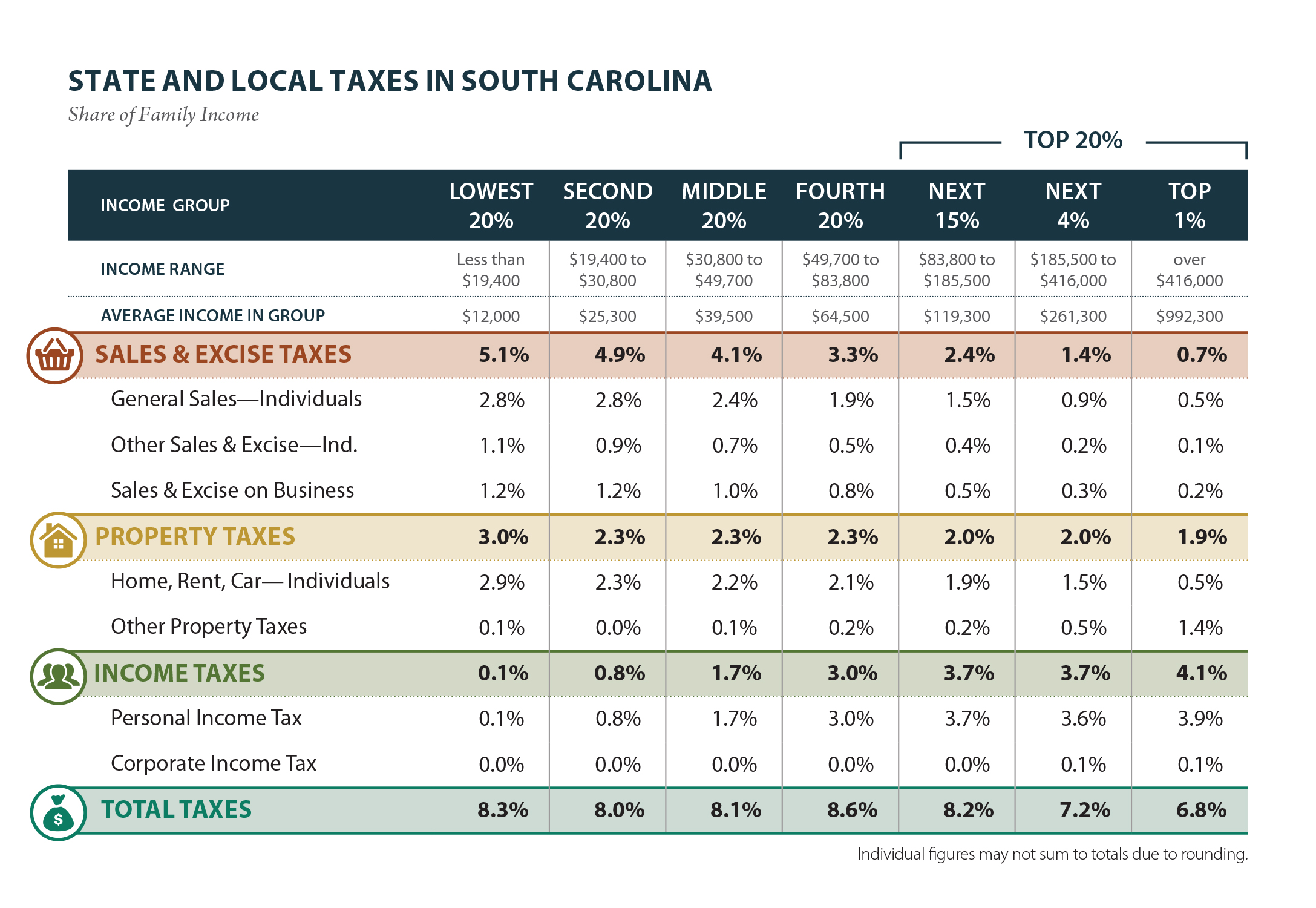

South Carolina S Uncompetitive Income Tax The South Carolina Policy Council

2022 State Tax Reform State Tax Relief Rebate Checks

The Best States For An Early Retirement Early Retirement Family Health Insurance Life Insurance For Seniors

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Full Page Layout For Kiplingers Personal Finance Magazine Illustration Doodlesandstuff Andrewjoyce Illustrator I Gambling Humor Gambling Quotes Gambling

South Carolina Who Pays 6th Edition Itep

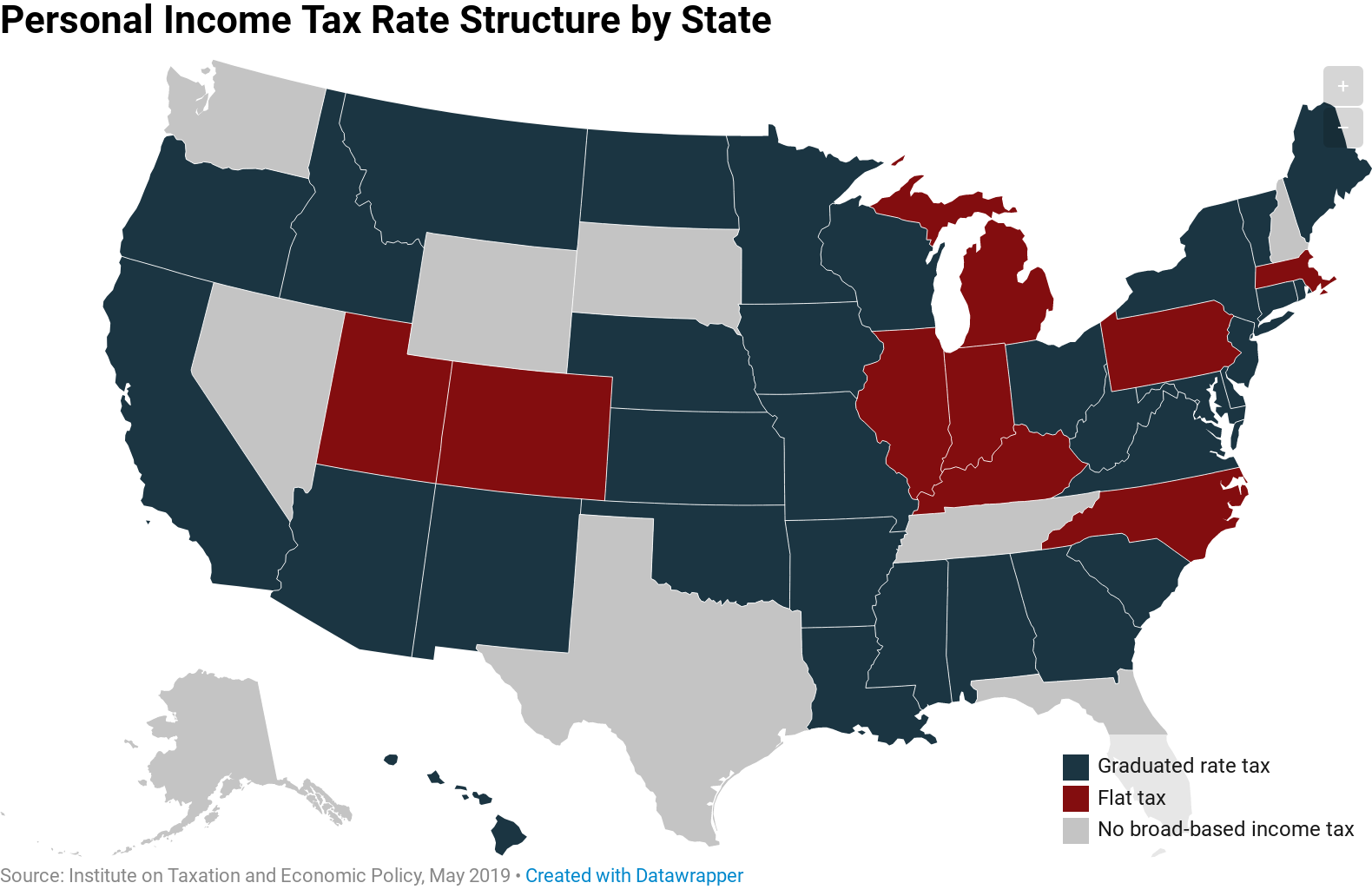

How Does Your State Tax Income Itep

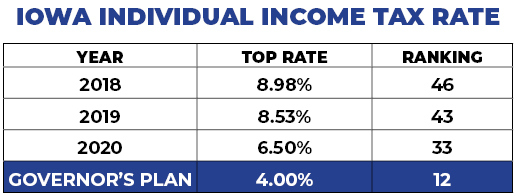

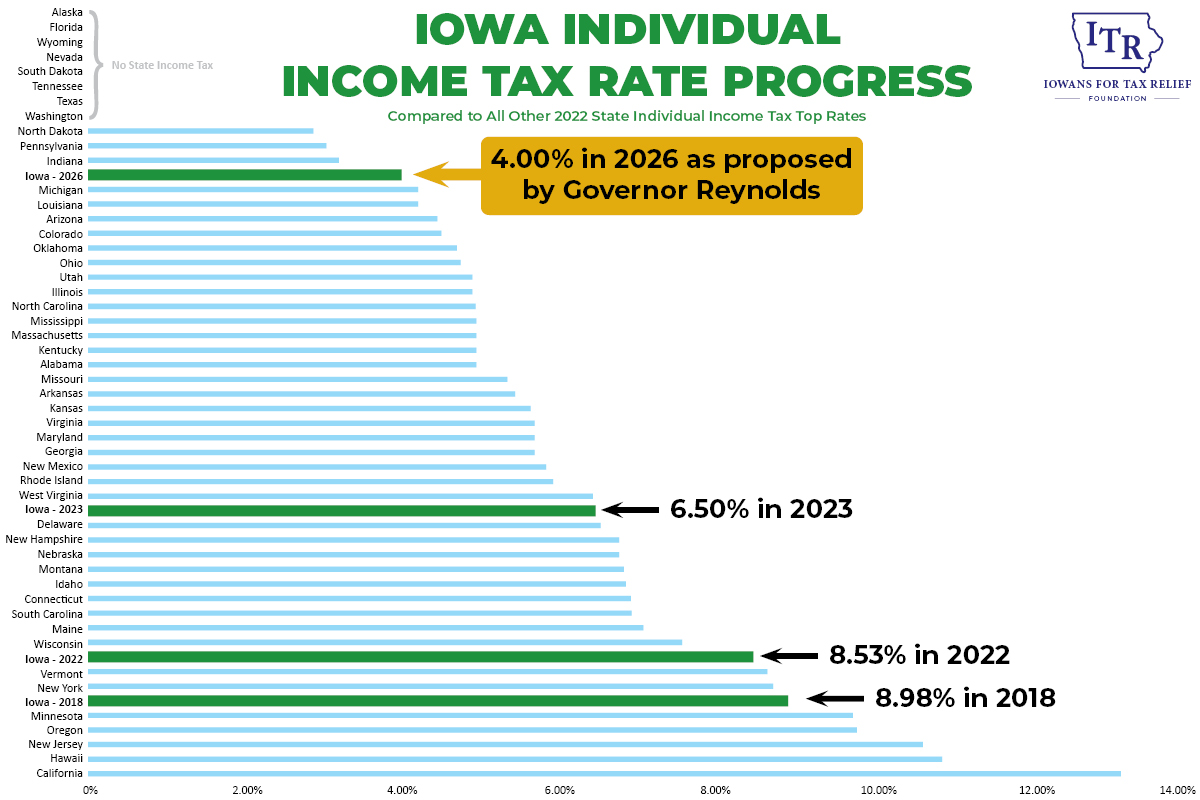

Governor S Tax Plan By The Numbers Iowans For Tax Relief

The Best And Worst States For Retirement Ranked Huffpost Life Retirement Best Places To Retire Retirement Community

Governor S Tax Plan By The Numbers Iowans For Tax Relief

These 7 U S States Have No Income Tax The Motley Fool

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Mississippi Ranks 30th In 2022 Tax Foundation State Business Tax Climate Index Mississippi Politics And News Y All Politics